Pic Credit: CoinCentral

Stock market information for SoFi Technologies Inc (SOFI)

- SoFi Technologies Inc is a equity in the USA market.

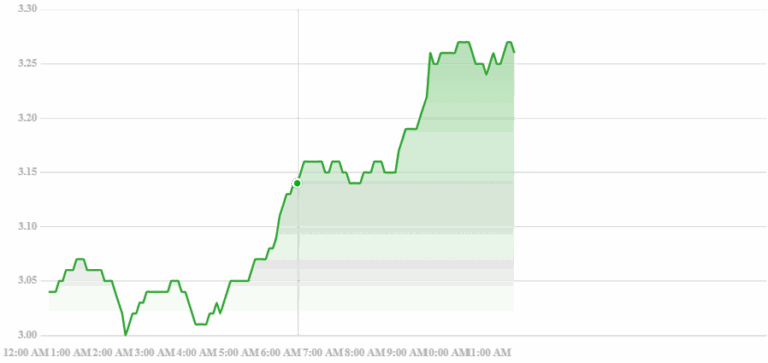

- The price is 24.26 USD currently with a change of 3.24 USD (0.15%) from the previous close.

- The latest open price was 23.08 USD and the intraday volume is 110691851.

- The intraday high is 25.08 USD and the intraday low is 20.83 USD.

- The latest trade time is Tuesday, July 29, 20:15:29 +0530.

SoFi Technologies Inc. (SOFI) has captured market attention with a sharp surge in stock price following its blockbuster Q2 2025 earnings report. On July 29, SoFi shares gained as much as 16%, trading around $24, after delivering results that significantly outpaced expectations.

🚀 Key Drivers Behind the Momentum

1. Strong Earnings and Revenue Beat

In Q2 2025, SoFi posted adjusted earnings of $0.08 per share, surpassing the consensus estimate of $0.06. Net revenue soared 44% year-over-year to $858 million, the highest growth rate in over two years. The company achieved double-digit growth across all segments:

- Lending revenue: +32% to $447M

- Financial services revenue: +106% to $303M

- Tech platform segment: +15% to $110M

2. Soaring Member Growth & Loan Originations

SoFi added a record 850,000 new members, raising its total to 11.7 million, a 34% increase year-over-year. Loan originations climbed to $8.8 billion, including 92% growth in home loans and personal loans up 64%.

3. Raised Full-Year Guidance

Reflecting confidence in strong fundamentals, SoFi raised its full-year 2025 guidance, expecting $3.375 billion in adjusted revenue and $960 million in adjusted EBITDA. EPS guidance was updated to $0.31 per share from the prior $0.27–$0.28 range .

4. Expanding Ecosystem & Diversification

SoFi’s platform model allows monetizing declined loan applications via its Loan Platform Business, which generated $380 million in annualized fee revenue in under 12 months. The company has struck over $8 billion in institutional partnerships, boosting low-risk revenue potential (Forbes).

SoFi has built an integrated financial ecosystem, offering services across lending, banking, insurance, investing, and technology platforms. As of 2024, nearly 45–49% of its adjusted net revenue came from higher-margin Financial Services and Tech Platform segments, a major shift away from lending dependency (The Motley Fool, markets.businessinsider.com, Forbes).

5. Innovation: Crypto, AI & Private Market Funds

New offerings like private-market funds featuring exposure to high-profile startups (e.g. OpenAI, SpaceX), launched with minimums as low as $10, generated excitement and stock uplift (~4%) recently. SoFi also re-entered the crypto space with blockchain-enabled money transfer features and digital currency support, further broadening its tech-forward image.

Laboring on innovation, the company is testing AI and blockchain technologies across its operations—from chatbots and fraud detection to compliance workflows.

🧭 Market Sentiment & Outlook

Analyst Views

While bullish sentiment has gained traction—some analysts raised price targets toward $20—others remain cautious. Bank of America sticks with an “Underperform” rating and a $13 target, citing slower growth in the tech segment due to longer implementation cycles . Meanwhile, Mizuho and Needham raised targets to $20, noting solid fundamentals and positive member acquisition momentum.

Valuation Context

At its recent price, the stock trades at a forward P/S multiple of around 5.3x, in line with its four‑year average of ~5.5x—but still high relative to traditional banks. If SoFi achieves projected EPS of $0.64 by 2027, the forward P/E multiple would compress to ~13x, comparable to established financial institutions (Forbes, markets.businessinsider.com, Forbes).

Volatility Potential

Options markets signal implied post‑earnings swings of up to ±9.4%, indicating trader expectations of continued volatility. As of July 29, the average analyst target remained ~$15.44—well below current trading, reflecting lingering skepticism about sustainability of growth.

✅ Final Analysis

SoFi is trending due to a powerful combination of accelerating revenue, record membership growth, diversified income streams, and innovation in fintech services. Strong Q2 2025 results have validated its transformation from a loan‑focused firm into a comprehensive financial platform. Elevated valuation multiples reflect investor optimism—but also signal vulnerability if growth stalls or macro conditions worsen.

For long-term investors targeting fintech innovation and demographic momentum, SoFi offers compelling upside. But for those prioritizing stability and conservative valuation metrics, the stock’s premium may raise caution flags.

TL;DR

- Q2 2025 delivered strong beats, with EPS of $0.08 vs $0.06 expectation and 44% revenue growth to $858M

- Membership and loans saw major gains: 850K new members, $8.8B in originations

- Guidance raised: full-year revenue $3.375B, EPS $0.31

- Diversifying, fee-based business model reduces reliance on low-margin lending

- Innovation push includes crypto products, private-market funds, and AI deployment

- Valuation debate continues, with targets ranging from $13 to $20

- Potential volatility ahead, with option markets pricing in ~9% swings after earnings

Read more here