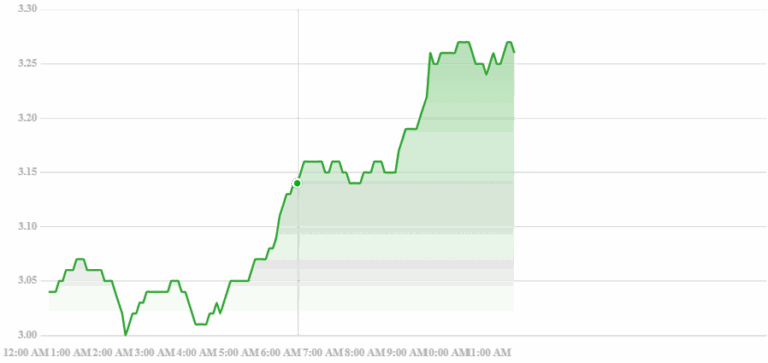

Pic Credit: TipRanks

Novo Nordisk’s (NYSE: NVO) stock has recently experienced significant turbulence, dropping over 20% to $54.04 on July 29, 2025, marking its worst trading day since the 1987 Black Monday crash. This sharp decline has raised concerns among investors and analysts alike.

Revised Financial Outlook

The company revised its 2025 financial guidance, lowering sales growth expectations to 8%-14% from the previous 13%-21%, and operating profit growth to 10%-16% from 16%-24% (Investors). This adjustment reflects increased competition in the diabetes and obesity medication markets, particularly from Eli Lilly’s Mounjaro and compounded GLP-1 drugs.

Leadership Transition

Adding to the uncertainty, Novo Nordisk announced the appointment of Maziar Mike Doustdar as the new CEO, effective August 7, 2025, following the retirement of Lars Fruergaard Jørgensen. Leadership changes can often lead to market volatility as investors await the new direction and strategies.

Market Position and Competition

Despite being a leader in the GLP-1 segment with drugs like Ozempic and Wegovy, Novo Nordisk faces intensified competition. Eli Lilly’s Mounjaro has gained significant market share, and the proliferation of compounded GLP-1 drugs has further eroded Novo Nordisk’s dominance.

Investor Sentiment

The combination of lowered financial forecasts, leadership changes, and increased competition has led to a decline in investor confidence. The stock’s Relative Strength Rating has dropped to 11 from 83, indicating a significant shift in market perception (Investors).

Looking Ahead

While Novo Nordisk continues to be a major player in the pharmaceutical industry, the recent developments suggest a period of adjustment. Investors will be closely monitoring the company’s response to competition, the effectiveness of its new leadership, and the impact of its revised financial outlook.

In conclusion, Novo Nordisk’s NVO stock is navigating through challenging waters. The coming months will be crucial in determining whether the company can regain its footing and restore investor confidence.

Read more here