Stock market information for XRP (XRP)

- XRP is a crypto in the CRYPTO market.

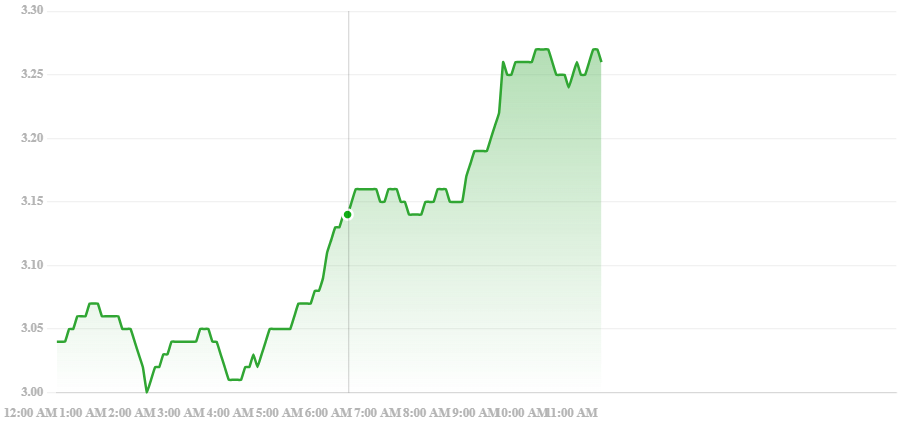

- The price is 3.27 USD currently with a change of 0.32 USD (0.11%) from the previous close.

- The intraday high is 3.27 USD and the intraday low is 2.95 USD.

Ripple’s XRP has surged to fresh record territory today, marking a milestone in its volatile but increasingly bullish trajectory. Here’s a detailed look at what fueled the surge, how XRP compares to its past all-time highs, and what it might mean for investors.

🚀 XRP Breaks Fresh Ground

XRP is trading around $3.27, pushing past its previous 2021-era peak of ~$3.40—depending on source—with real-time highs flirting with $3.30–$3.31 . For reference, some platforms list its ultimate all-time high around $3.84, though that refers to intraday spikes . In any case, today’s highs are its strongest since its biggest bull runs.

🔎 What’s Fueling the Rally?

- Regulatory momentum in Washington: The U.S. House recently advanced the GENIUS Act (stablecoin legislation), signaling progress on crypto regulations. Analysts note that this paves the way for Ripple’s RLUSD stablecoin to flourish on the XRPL—benefiting XRP’s liquidity position (BeInCrypto).

- Bullish technical structure: Following a classic three-phase pattern (touch past high, consolidate, breakout), XRP has now decisively entered price-discovery territory—technical analysts anticipate a run beyond $3.30, supported by strong volume and RSI indicators (AInvest).

- Surging derivatives activity: Open interest in XRP futures has hit record highs (~$8.8B), marking strong institutional and leveraged interest. Funding rates are positive—longs are paying to stay married—signaling conviction (Decrypt).

- On-chain burn spike: XRP ledger saw roughly 14 million XRP burned—another all-time high—indicating increased transactional activity and rising demand (U.Today).

📊 Historical Context & Comparison

- All-time high perspective: The 2021 intraday price peaked near $3.84, but most platforms mark ~$3.40 as the record close (Coinbase). At current ~$3.27–$3.30 levels, XRP is now inches from those highs.

- Volume & momentum: Its 7-day gains are north of 30%, with daily moves around 10%.

- Relative performance: XRP outperforms in the broader crypto rally; it’s up over 430% year-over-year, surpassing many peers .

💡 What Comes Next?

- Key resistance levels: A clean breakout above ~$3.30–3.40 could trigger a “price discovery” phase aiming for $4.00+ (AInvest). Current support sits around $2.85–$3.00—if breached, a pullback to $2.70–$2.85 may ensue.

- Regulatory catalysts: Upcoming committees, SEC appeal developments, and final approval of the GENIUS Act are all critical. Analysts also highlight the SEC possibly dropping its Ripple appeal—this legal clarity could unlock XRP spot ETF possibilities (FXEmpire).

- Network growth: Spike in burns signals more transactions and active adoption—suggesting real utility, not just speculative investment (U.Today). Continued network usage will feed further price support.

🌐 Ripple Ecosystem & Broader Implications

Ripple Labs, founded in 2012 in San Francisco, continues to expand its enterprise-grade blockchain tools built on the XRP Ledger. This includes payment rails, on‑chain settlement, and now the RLUSD stablecoin tied to regulatory frameworks (BeInCrypto). Legal wins have reduced regulatory overhang; notably, Judge Torres ruled XRP tokens are not securities, and SEC claims against Ripple executives were dropped.

If the GENIUS Act passes and the SEC appeal is withdrawn, XRP’s dual utility—as settlement and speculative asset—could gain mainstream legitimacy. This may trigger renewed interest from institutional investors and pave the way for new financial products.

✍️ Final Take

XRP has surged into new all-time high territory, reaching $3.30+ on strong technicals, regulatory catalysts, booming derivatives interest, and real network usage. With legislative progress and potential SEC clarity, we’re likely witnessing the early phase of a sustained bull cycle.

That said, as with all cryptocurrencies, risks remain high: volatility can lead to sharp reversals, and outcomes hinge on developments in legislation, litigation, and market sentiment. For traders, monitoring the $3.30–3.40 resistance zone—and key support at $2.85–$3.00—will be essential. Long-term investors may view today’s breakout as confirmation that XRP is stepping into a new phase.